Home » Leadership Resources » Tech Database » Considerations for Decisionmakers Part 3

Considerations for Decisionmakers

PART III: Policy Framework for Africa’s Digitalization

The African Union recognized digitalization as a catalyst for ending poverty by adopting the Digital Transformation Strategy for Africa (2020-2030) as a master plan to direct Africa’s digital agenda for the upcoming years. This master plan intends to promote connectivity and entrepreneurship, create jobs, and provide technology support to position Africa as a hub of technological progress with the potential to have great societal and economic effects. As such, many decision-makers across the continent are investing in creating a supportive regulatory environment for technology adoption, with policies aiming to promote innovation and digital inclusion.

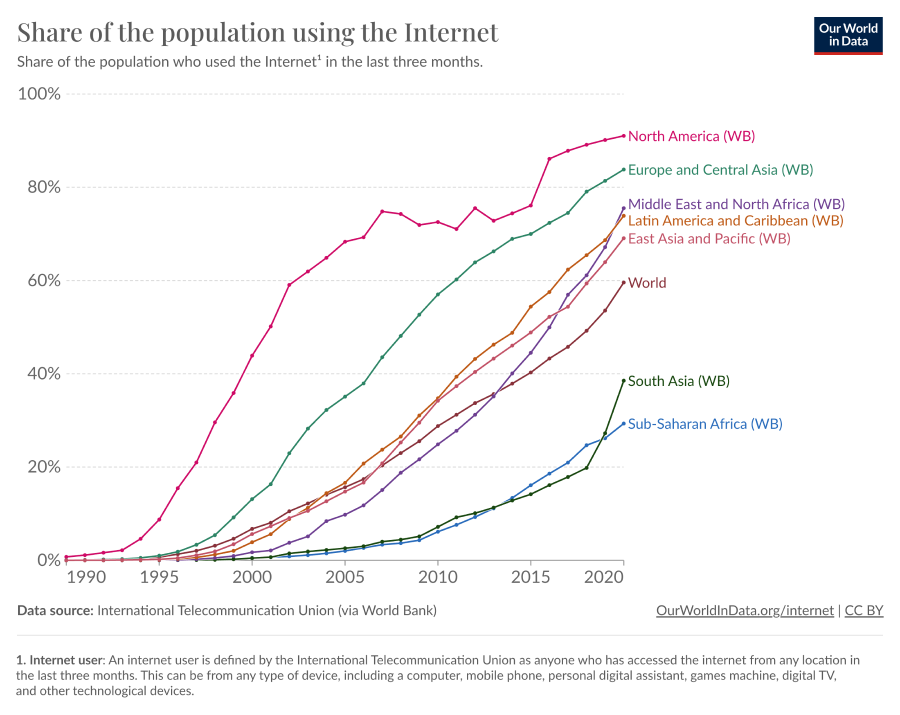

Graph 1: Share of the Population Using the Internet

Globally, Africa has the fastest-growing population, yet less than 50 % of it currently uses the Internet. A study noted that “One of the contemporary challenges facing the African continent is the significant technological gap between African countries and the rest of the world. Bridging this gap is crucial to the success of the poverty alleviation agenda in sub-Saharan Africa.”

1. Technology hubs for a growing population

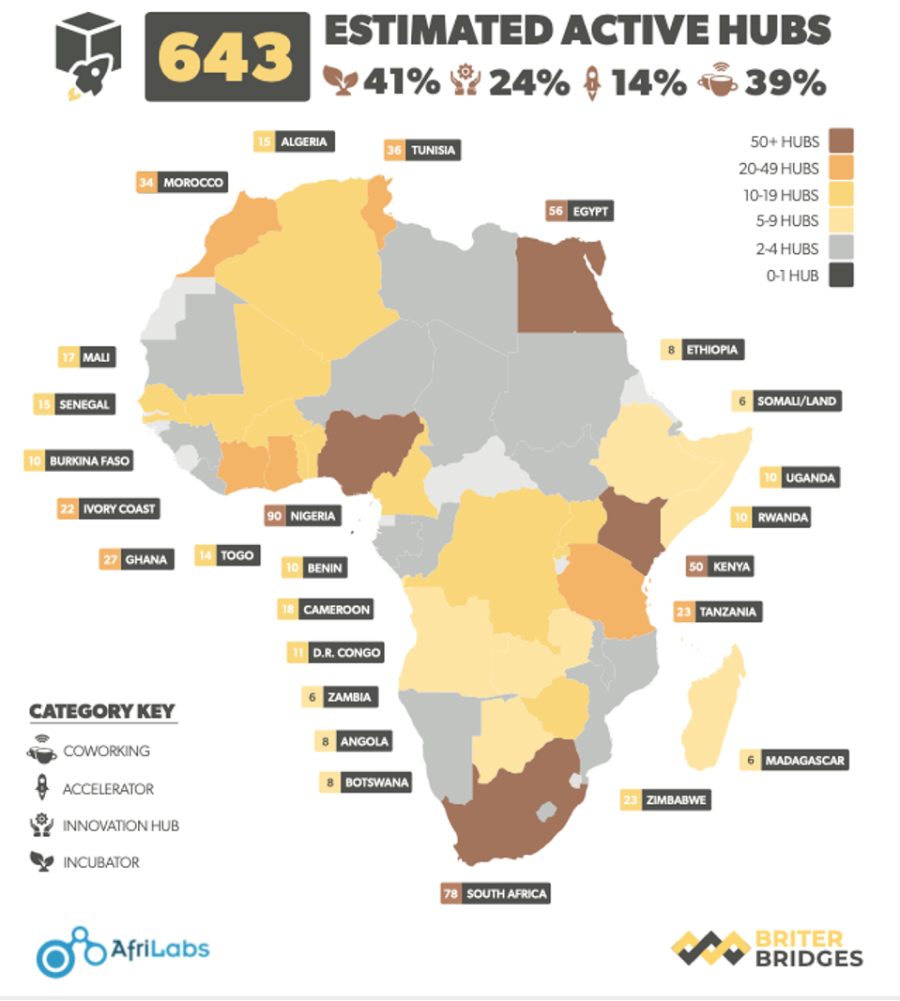

To address this digital divide, create jobs, and improve the livelihood of the growing African population, a critical area of focus for decision-makers has been to improve connectivity in urban and rural areas by partnering with the private sector. Consequently, Africa has witnessed the rise of technology hubs and innovation centers, where startups and entrepreneurs are supported in developing innovative solutions to address local challenges. These hubs provide access to resources, mentorship, and funding, fostering a vibrant ecosystem of tech-driven innovation.

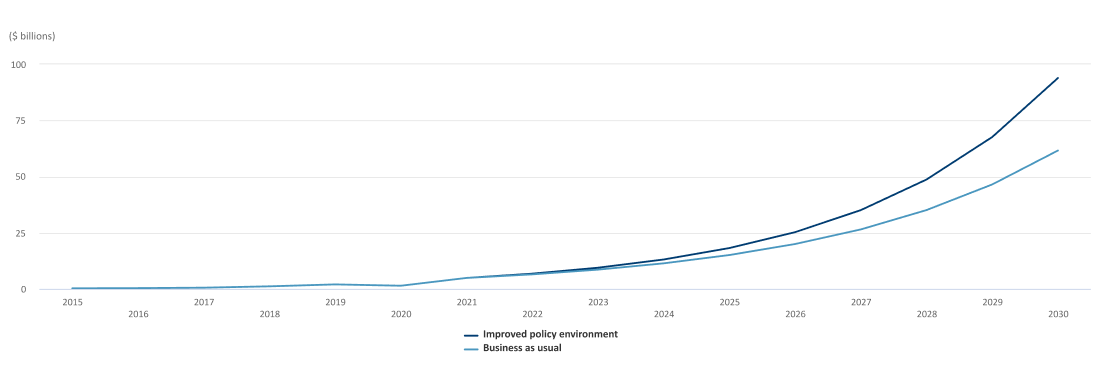

However, despite an increase in funding for African tech startups since 2015 as well as a rise in the number of startups, technology hubs, and tech entrepreneurs, in general, still face challenges in scaling up their enterprises and securing funding, leading to many startup failures. Factors contributing to the difficulty of scaling up tech enterprises in Africa include the continent’s fragmented market of 54 countries, low consumer spending power, complex and varying regulations, inadequate data communication infrastructure, and a lack of capital and digital talent. Therefore, to address some of these challenges, it is important for governments across the continent to establish clear policies and regulations that can promote innovation, investment in communication infrastructure, capital, and digital talent, as well as a unified market within and across all African countries.

However, despite an increase in funding for African tech startups since 2015 as well as a rise in the number of startups, technology hubs, and tech entrepreneurs, in general, still face challenges in scaling up their enterprises and securing funding, leading to many startup failures. Factors contributing to the difficulty of scaling up tech enterprises in Africa include the continent’s fragmented market of 54 countries, low consumer spending power, complex and varying regulations, inadequate data communication infrastructure, and a lack of capital and digital talent. Therefore, to address some of these challenges, it is important for governments across the continent to establish clear policies and regulations that can promote innovation, investment in communication infrastructure, capital, and digital talent, as well as a unified market within and across all African countries.

Graph 2: Active Hubs in Africa (2019 Estimates)

3. Leadership and Collaboration

Having a single national digitalization plan and implementing agency is crucial to ensuring coordination across government to avoid duplication, as well as investment in technologies that may not be fit for purpose. In most countries, digitalization is coordinated and implemented by a government entity or agency led by a Minister or Secretary of Technology, Information, or a related title. For example, after setting their vision for digitalization in Egypt, “In alignment with Egypt Vision 2030 and Egypt’s digital transformation strategy, the Ministry of Communications and Information Technology [has] embarked on building Digital Egypt.”

A central function of the responsible Minister is to ensure that all ministries ‘buy into’ and conform to the national plan. This may not be easy because there will be different perspectives on such things as the pace of digitalization, the initial priorities, and the most appropriate technologies. Where such disagreements impede progress, intervention by the Prime Minister or even the President may be necessary. The point to consider is that digitalization of government will be controversial for some and assertive leadership will be important to avoid having the plan derailed.

A central function of the responsible Minister is to ensure that all ministries ‘buy into’ and conform to the national plan. This may not be easy because there will be different perspectives on such things as the pace of digitalization, the initial priorities, and the most appropriate technologies. Where such disagreements impede progress, intervention by the Prime Minister or even the President may be necessary. The point to consider is that digitalization of government will be controversial for some and assertive leadership will be important to avoid having the plan derailed.

Moreover, in The Future of Work in Africa: Harnessing the Potential of Digital Technologies for All, the authors explain that to “generate the jobs and economic transformation that Africa needs” via technology, African decision-makers should:

- “Enable entrepreneurship: let good ideas flourish no matter where they come from – so that African entrepreneurs build technology solutions that enable Africa’s workers to build their skills as they work.”

- “Enhance the productivity of the informal sector: create a business environment that helps boost the productivity of informal businesses and workers rather than focusing only on trying to formalize them.”

- “Extend social protection coverage: improve revenue collection; rebalance government spending, and more effectively coordinate development assistance.”

Graph 3: Projecting growth in tech-startup funding under two scenarios: business as usual versus an improved policy environment

2. Taxation: Opportunity for technology-driven revenue

Public-private partnerships (PPP) have proven necessary to address challenges such as infrastructure limitations to ensure that technology reaches and benefits all population segments. However, PPP necessitates clear laws to drive government revenue while improving citizens’ lives. But, working with the private sector, governments across Africa, like their global counterparts, face issues like the taxation of private technology entities for revenue, with an example of the DRC that recently sealed Vodacom offices, a mobile network operator, over a tax dispute.

With 58% of Sub-Saharan Africans now having registered mobile accounts and 54% of adults utilizing FinTech to make payments, leading to $760 billion in estimated flows and $3 billion in total FinTech revenues annually, many governments have a newfound opportunity for technology-driven revenue, and an excellent regulatory environment is necessary to support continued investments and Fintech innovations. However, be aware that over-zealous taxation of a nascent tech sector could thwart its development.

The Taxation of Financial Technology in Africa highlighted that “If a conservative estimate of revenues at 2% of volume is applied, it would result in annual revenues of about $6.6 billion from electronic payments alone. It is now estimated that the FinTech industry in Africa in 2022 will contribute between $200 million and $3 billion in revenues annually. This demonstrates that the correlation between FinTech and revenue mobilization is quite strong. It thus becomes necessary to understand whether and how FinTech in Africa is taxed.” Per this study, having a sound tax system for FinTech means the government would know what activities can be taxed, hence making money to fund public services, which would help with development and social goals.

With 58% of Sub-Saharan Africans now having registered mobile accounts and 54% of adults utilizing FinTech to make payments, leading to $760 billion in estimated flows and $3 billion in total FinTech revenues annually, many governments have a newfound opportunity for technology-driven revenue, and an excellent regulatory environment is necessary to support continued investments and Fintech innovations. However, be aware that over-zealous taxation of a nascent tech sector could thwart its development.

The Taxation of Financial Technology in Africa highlighted that “If a conservative estimate of revenues at 2% of volume is applied, it would result in annual revenues of about $6.6 billion from electronic payments alone. It is now estimated that the FinTech industry in Africa in 2022 will contribute between $200 million and $3 billion in revenues annually. This demonstrates that the correlation between FinTech and revenue mobilization is quite strong. It thus becomes necessary to understand whether and how FinTech in Africa is taxed.” Per this study, having a sound tax system for FinTech means the government would know what activities can be taxed, hence making money to fund public services, which would help with development and social goals.

3. Tracking progress

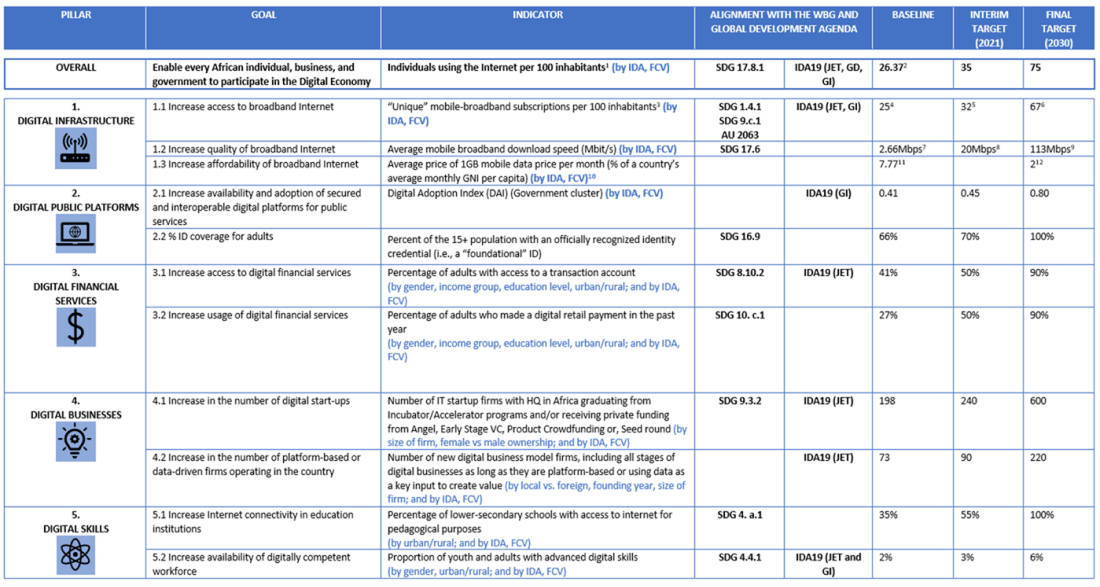

Governments aiming to achieve digital transformation intended to produce a range of positive outcomes and improved well-being for citizens should set clear and bold targets within the five core components of the digital economy, as proposed by the Digital Economy for Africa initiative:

Graph 4: Digital Economy for Africa initiative’s indicators

Notes

This paper was researched and written by Benita Kayembe, Senior Researcher & Michael R. Sinclair, Executive Director, Harvard Ministerial Leadership Program.

None of the opinions expressed are necessarily those of Harvard University or the funders of the Harvard Ministerial Leadership Program. © 2023 President and Fellows of Harvard College.

None of the opinions expressed are necessarily those of Harvard University or the funders of the Harvard Ministerial Leadership Program. © 2023 President and Fellows of Harvard College.